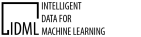

Stablecoin Architecture: Issuance & Oversight

– State-Backed Stablecoin (KGST): Pegged 1:1 to the Kyrgyz som, fully backed by reserves held by the central bank[1]. Issued by NBKR under new digital asset laws, ensuring legal status and trust[1].

– Technology Platform: Built on a secure blockchain (BNB Chain) through a public-private partnership (with Binance as a technical partner)[2]. The platform handles token creation, transactions, and redemption.

– Distribution Channels: Commercial banks, mobile wallets, and payment providers distribute and exchange the stablecoin for citizens and businesses, integrating with existing payment systems.

– Oversight & Governance: NBKR regulates all issuers and wallets, monitors reserves in real time, and enforces a 1:1 backing. Robust risk controls ensure price stability and consumer protection. (The NBKR’s gold/gray branding is applied for a formal, national look.)

Speaker Notes: Kyrgyzstan’s national stablecoin – informally known by its ticker KGST – is designed and overseen by the National Bank. It’s pegged one-to-one to our som[1], meaning every digital coin is backed by a som in reserve. This isn’t a private crypto experiment; it’s an official sovereign currency instrument. In October, we launched KGST on the BNB blockchain in partnership with Binance[2], marrying our monetary authority with cutting-edge fintech. This diagram shows how it works: the central bank issues the stablecoin and holds reserves, while banks and fintech providers distribute it to users. Oversight is paramount – NBKR regulates every link of the chain to ensure stability and trust. Our design uses the National Bank’s branding – the gold and gray motif – underlining that this innovation is firmly grounded in the Kyrgyz state’s authority and stability. In short, we have a modern digital currency architecture that remains under national control, supporting confidence as we enter the digital finance era.

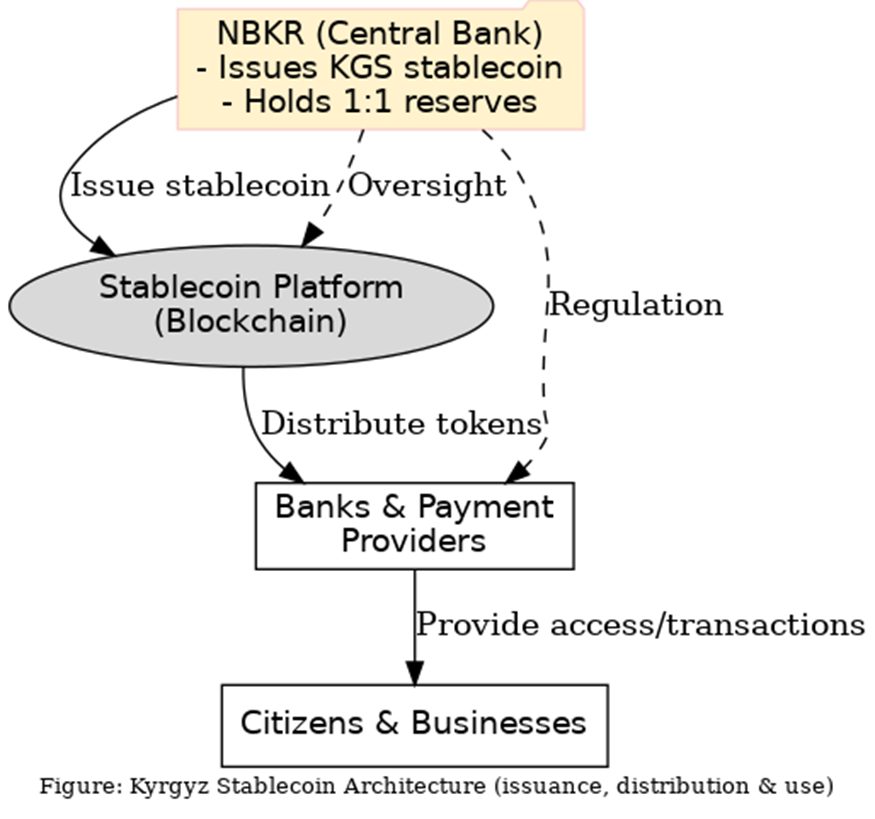

Use Case: Affordable Remittances for Citizens

– Remittance Lifeline: Remittances account for over 30% of Kyrgyzstan’s GDP[3] – one of the highest shares in the world. Millions of our migrant workers abroad support families back home.

– Pain Points: Traditional money transfers can be costly (global fees often 5%+ of amount) and slow, with rural families traveling to pick up cash. Even though Russia–Kyrgyz corridors have lower fees (~1%), any avoidable cost is money lost for our citizens.

– Stablecoin Solution: A Kyrgyz worker in, say, Russia can buy KGS-pegged stablecoins and send them instantly to a family wallet in Kyrgyzstan[4]. Transfers happen in minutes, not days, at minimal cost (just a few basis points network fee). The family receives digital som on their phone and can cash out to local currency or spend it directly.

– Impact: If we reduce remittance fees by even 1-2%, that’s $20–30 million more in Kyrgyz families’ pockets annually (given ~$2.9B in remittances in 2024[5]). Faster, cheaper remittances mean greater disposable income, poverty reduction, and financial inclusion for rural communities.

Speaker Notes:

Remittances are our economy’s lifeblood – over a third of our GDP comes from citizens working abroad sending money home[3].

Every som lost to high transfer fees is a som not feeding a family or building a house in Kyrgyzstan. With our stablecoin, a migrant in Moscow can open a wallet, purchase digital som, and instantly send it to Bishkek or Osh.

The diagram here illustrates this: money moves from the worker’s phone, through the blockchain, directly to the family’s phone.

No costly intermediaries, no waiting in line at a transfer office. The cost is pennies, not the percentage points charged by traditional services.

This means a bigger portion of the 2.9 billion dollars[5] in annual remittances arrives in our people’s hands – potentially adding tens of millions of dollars to local spending. It’s not just about cost: speed matters too. Emergencies won’t wait days for a bank transfer. With the stablecoin, money is available within minutes, even in a remote village, as long as there’s cell service. We’re also advancing financial inclusion – today, only about 22% of remittance-receiving households got funds into an account digitally in 2021 (up from 4% in 2016)[6]. We will raise that sharply. In short, our national stablecoin transforms remittances into a faster, cheaper, and more accessible lifeline for every Kyrgyz family relying on sons and daughters abroad.

Use Case: Facilitating Cross-Border Trade

– Current Challenges: Businesses face costly, slow international payments. Cross-border trades often rely on intermediary banks, USD conversions, and SWIFT transfers – incurring fees and delays. Kyrgyzstan’s total trade (imports+exports) is over 100% of GDP[7], so these frictions hit our economy hard.

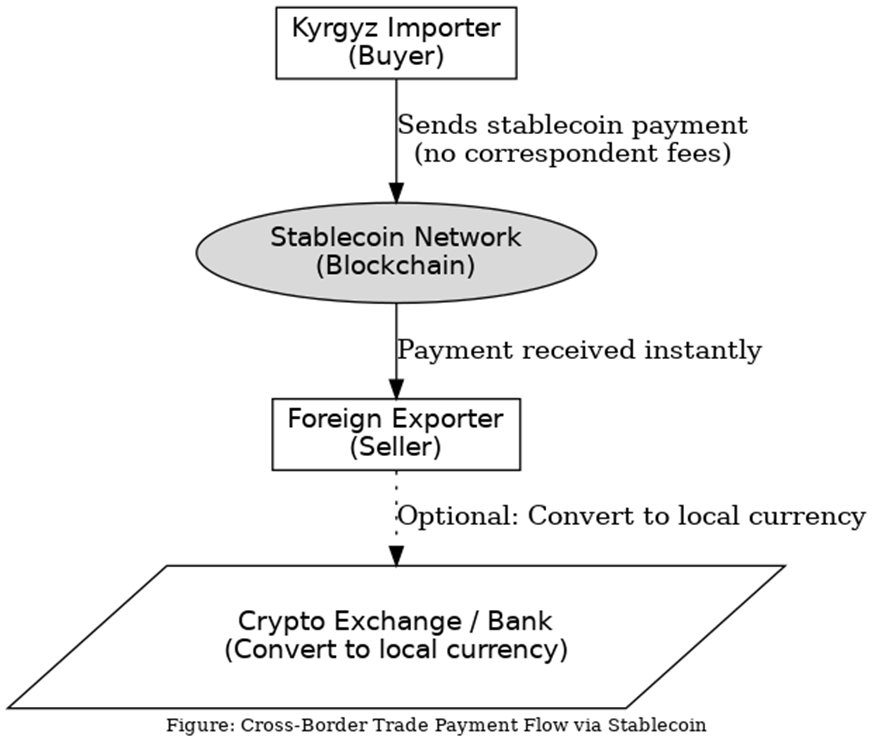

– Stablecoin Payments: A Kyrgyz importer can pay a foreign supplier in stablecoin (digital som or even a som-denominated token convertible abroad) instantly, without correspondent bank fees. The supplier receives payment in minutes with transparency and can convert to their currency via exchanges if needed. This bypasses multiple currency conversions and days of wait.

– Benefits: Reduced transaction costs for businesses (saving on bank fees, forex spreads) and faster delivery of goods thanks to immediate payment confirmation. Even a modest 1% efficiency gain on trade transactions (through lower fees or quicker turnover) could save the economy the equivalent of ~1% of GDP in value[7].

– Boosting SMEs: Small exporters and importers, who often struggle with expensive L/Cs (letters of credit) or lack of banking relationships, can participate more easily. A farmer cooperative can import equipment or export produce with less overhead, improving competitiveness.

– Sovereignty in Trade: Using a som-pegged digital currency promotes use of our national currency in international settlements, reducing dependency on the US dollar or other foreign units. This strengthens monetary sovereignty and could buffer our trade in times of external sanctions or shocks[8].

Speaker Notes: Kyrgyzstan is a trading nation – from our agricultural exports to the goods filling Dordoi market, cross-border commerce is our lifeblood. But ask any trader or factory owner, and you’ll hear frustrations about wire transfers taking days or the dollars lost to bank commissions and exchange rates. By one measure, our total merchandise trade is about 108% of GDP[7] – so inefficiencies in payments are a drag on growth. Our stablecoin can change that. Imagine a Bishkek textile firm buying fabric from Uzbekistan: instead of navigating multiple banks and currency conversions, they simply transfer Kyrgyz digital som to the Uzbek seller’s wallet. The seller sees the payment immediately and can convert to Uzbek soum or hold it – all within the same day. No 3-day SWIFT wait, no 1-2% hidden forex fee. For our businesses, especially small and mid-size ones, this is revolutionary. Faster cash flow and lower costs mean they can reinvest, offer better prices, and compete regionally. Crucially, transacting in our own digital som or a Kyrgyz-issued stablecoin also extends our economic sovereignty. We reduce reliance on the US dollar or other intermediaries. In a world where sanctions and global uncertainties can disrupt dollar payments[8], having our own digital payment rails ensures our traders keep moving goods. We’re effectively creating a Central Asian trade network where Kyrgyzstan is a leader in fast, secure digital transactions – an advantage that will attract partners and investors to our market.

Use Case: Government Payments & Social Programs

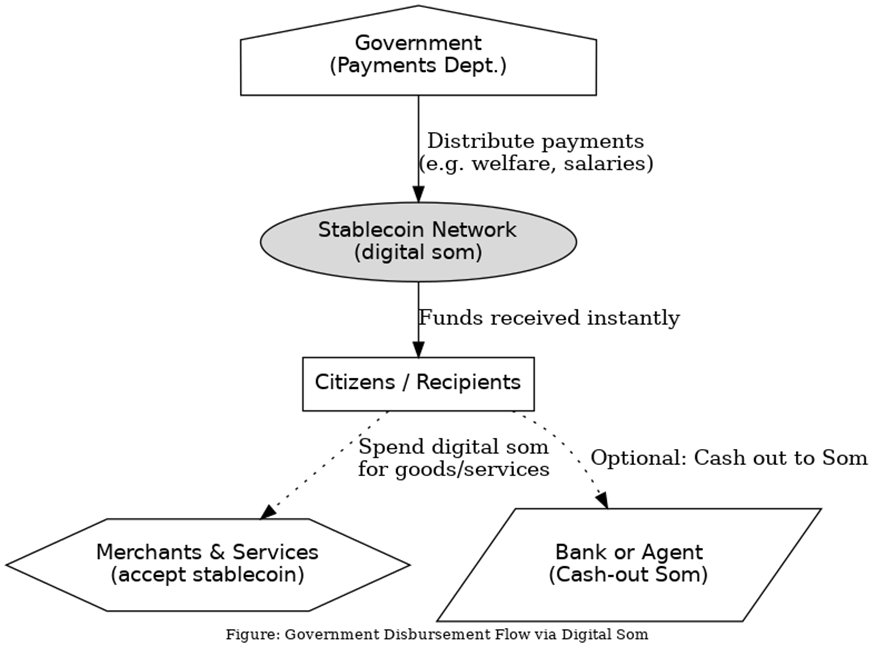

– Modernizing State Payments: The government (e.g. Ministry of Finance or social fund) can disburse salaries, pensions, and welfare benefits as digital som directly to citizens’ e-wallets. This reaches people even in remote areas instantly, without needing bank accounts.

– Efficiency & Savings: Digital payments eliminate intermediaries and manual processes. This cuts down on administrative costs, bank fees for bulk payments, and leakage in cash distribution. Kyrgyzstan’s broader digitalization of services is already estimated to save around $300 million per year[9] in the public sector – introducing digital currency to government payments will add further savings. For context, $300M is about 3% of GDP – a significant efficiency gain that can be redirected to development.

– Transparency & Anti-Corruption: Every transaction on the stablecoin ledger is traceable by authorities. This transparency helps curb corruption (e.g. “ghost” beneficiaries or skimming of cash). Funds go exactly where authorized, strengthening public trust in social programs.

– Financial Inclusion for the Unbanked: Many low-income or rural citizens may not have bank accounts but do have mobile phones. By receiving benefits through a mobile wallet, financial inclusion rises. People can then transact digitally or cash out at local agents as needed. The digital som will work even in areas with limited banking presence, ensuring no citizen is left behind in getting their due payments[10].

– Innovation in Policy Delivery: A digital currency also enables new policy tools – for example, “programmable” welfare that can be targeted for specific goods (if desired) or emergency aid disbursed rapidly after a disaster. It positions Kyrgyzstan’s government as agile and tech-forward in service delivery.

Speaker Notes: Our government is making a bold leap into the future of public finance. Instead of the old way – printing lists, moving cash to regional offices, and making people queue up – we can now send out payments at the click of a button via the digital som. This slide shows how a welfare payment or pension would flow: the government issues digital currency into the recipient’s wallet instantly via the blockchain. Overnight, a herder in Naryn or a teacher in Batken sees the funds on their phone. They can either spend it directly at merchants (as digital payments spread to shops), or cash out some som if needed for physical money. The benefits are huge. We drastically cut processing costs and delays – remember, the ongoing digital reforms are saving us an estimated $300 million every year by streamlining services[9]. With digital currency, we trim even more fat: fewer middlemen and less chance for funds to “leak” en route. Importantly, digital payouts are transparent – each som is accounted for on the ledger, reducing the space for corruption or error. And think of the boost to inclusion: today, many villagers may not have bank accounts, but most have a mobile phone. Now, their phone becomes their wallet. This aligns perfectly with our mission of financial inclusion – bringing everyone into the formal economy. In crisis times, this system shows its strength too: if there’s an earthquake or a pandemic, we can support citizens immediately with digital cash transfers, even to the most remote valleys, without waiting for physical aid delivery. It’s a smarter, cleaner, and faster way to govern – leveraging our digital som to serve the people.

Economic Impact & Strategic Outlook

- Economic Sovereignty: By transacting in a Kyrgyz state-backed digital currency, we reduce reliance on foreign currencies and networks. This insulates our economy from external shocks and political risks. (For example, a regional digital payment network could bypass disruptions in dollar or SWIFT channels[8].) Maintaining control over our currency in the digital realm fortifies national sovereignty.

- Financial Inclusion & Growth: The stablecoin and digital som broaden financial access. More citizens with digital wallets means more participation in the formal economy – leading to greater savings mobilization and lending. Studies show that greater financial inclusion can boost GDP growth; even a modest uptick can add 0.5–1.0% to GDP over time through increased economic activity. We are already seeing rapid adoption of digital finance in Kyrgyzstan (e.g. 72% account ownership in 2025, up from 40% in 2017, with mobile wallets surging – indicating readiness for this leap).

- Efficiency Gains: Summing up the use-cases, the potential annual savings and additional economic output are significant: tens of millions saved on remittance fees, a similar scale in trade transaction cost reductions, and hundreds of millions saved in public sector efficiency[9][4]. These resources can be reinvested into our economy. Over a few years, the stablecoin ecosystem could easily contribute an extra percentage point to GDP via these channels.

- Innovation & Investment Climate: Embracing a national stablecoin places Kyrgyzstan at the forefront of fintech in Central Asia. It sends a powerful signal to investors, startups, and international partners that we are open for innovation. We have already attracted partnerships (e.g. Binance’s involvement, law enforcement training on crypto, university programs[11]). This ecosystem can spur a local fintech industry, create skilled jobs, and make us a regional technology hub.

- Next Steps: We will proceed with a phased rollout – first focusing on government and remittance use, then expanding merchant acceptance and cross-border arrangements (including talks for interoperability with other regional digital currencies). Regulatory frameworks are being continually refined to manage risks (cybersecurity, consumer protection, anti-money-laundering) in line with IMF and World Bank guidelines[12][13]. In parallel, public education campaigns are underway to build trust and understanding of the digital som.

Speaker Notes: What does all this mean for Kyrgyzstan’s economy and our strategic trajectory? In a word: empowerment. By taking control of digital currency, we assert our economic sovereignty. No longer will cross-border payments or sanctions hold us hostage – we’re carving our own path with partners we choose. This boosts our resilience against external shocks. Financial inclusion goes hand in hand with sovereignty. When a yurt-dwelling family in Talas can access digital financial services, that’s one more household contributing to the formal economy. More inclusion means more growth – even a small bump in economic activity from newly empowered citizens can translate to a noticeable uptick in GDP. We are confident that by rolling out the stablecoin broadly, we could see an additional half to one percent of GDP growth in the coming years, thanks to efficiency and inclusion gains. Efficiency, indeed, is a recurring theme: money saved is money earned. We’ve illustrated perhaps $400+ million in combined annual savings potential across remittances, trade, and government sectors (and that’s a conservative take)[9][4]. Those savings will be circulating in our economy instead of leaking out – fueling consumption, investment, and tax revenues. On the innovation front, Kyrgyzstan is no longer on the sidelines. We’re among the first in the world to launch a state-backed gold-pegged stablecoin (USDKG) and a som stablecoin[14], and we’re working on a CBDC pilot for public use. This pioneering spirit makes us attractive to investors and tech talent. We’re already seeing interest from fintech companies and positive coverage positioning Kyrgyzstan as a regional digital finance leader. Going forward, our approach will be step-by-step: ensure the system is secure and trusted, then scale it up. We’ll expand merchant acceptance so people can buy bread or pay utility bills in digital som. We’ll pursue interoperability – President Japarov has even discussed ideas of a Central Asian digital currency space for seamless regional trade. Of course, we will be prudent: our regulators are aligning with international best practices to prevent misuse and protect consumers[12]. In summary, the stablecoin initiative is more than a new payments tool; it’s a pillar of our national development strategy. It embodies economic independence, inclusive growth, and innovation. With it, Kyrgyzstan is stepping confidently into the future of finance – on our own terms.

Conclusion: Toward a Sovereign Digital Future

- Leadership and Vision: Kyrgyzstan is among the first movers in the region to implement a national stablecoin and pilot a CBDC – reflecting the vision of our President and Central Bank to embrace innovation for the public good[15][14]. This bold step aligns with our long-term development strategies and the “Digital Kyrgyzstan” agenda.

- Economic Sovereignty & Inclusion: The stablecoin initiative fortifies our economic sovereignty – the som in digital form will circulate widely at home and abroad, asserting our monetary independence. At the same time, it brings more of our citizens into the formal financial system, bridging urban-rural divides. Every Kyrgyzstani with a phone can be part of the modern economy.

- Secure and Trusted Implementation: We recognize that trust is the currency of any financial system. The NBKR and government will ensure the stablecoin system remains fully backed, secure from cyber threats, and user-friendly. Public outreach is ongoing to educate people and businesses. We will proceed deliberately, monitoring impacts and adapting as needed – always prioritizing stability.

- Regional and Global Standing: By harnessing blockchain technology responsibly, Kyrgyzstan is setting an example in Central Asia. We are ready to share our experience and collaborate on standards. This strengthens our voice in international forums (IMF, World Bank) as a country that innovates while safeguarding stability[16][12]. It could even lay the groundwork for greater regional financial integration, with Kyrgyzstan at the forefront.

- Commitment to Innovation: Finally, this initiative sends a clear message: Kyrgyzstan will continue to embrace innovation in pursuit of prosperity. We see technology as a means to empower our people, not as an end in itself. Today it’s a stablecoin; tomorrow we’ll leverage new tools – be it AI, digital trade platforms, or others – always with the aim of building a stronger, more inclusive, and more sovereign Kyrgyz Republic.

Speaker Notes: In closing, let me emphasize what this journey means for Kyrgyzstan. We are taking charge of our financial destiny. Through the vision of our leadership and the hard work of our National Bank and partners, we’ve turned an ambitious idea into reality: a Kyrgyz digital currency that serves our people. This is about economic sovereignty – our som will remain strong and relevant in a digital world, reinforcing our independence. It’s also about leaving no one behind: a yurt on the jailoo can now be connected to the global economy with a simple phone. A grandmother in a mountain village can receive her pension without a long bus ride to the bank. A young entrepreneur can access international markets from Bishkek with ease of payment. We are doing all of this carefully and securely. The trust of our citizens is paramount – and we will continue to earn it by keeping this system safe, stable, and transparent. On the global stage, Kyrgyzstan’s star is rising as a pioneer of digital finance in our region. Colleagues from other countries are watching our experiment with great interest[17]. We intend to show them that a small nation can lead in innovation while upholding stability and integrity. As President (or as Governor of the NBKR), I can say I am immensely proud of how far we’ve come. But this is just the start. Our commitment is that we will continue to innovate, continue to adapt, and always harness technology for the prosperity and empowerment of our people. Together, let’s embrace this sovereign digital future for Kyrgyzstan. Thank you.

Sources: Official data and statements from the National Bank of the Kyrgyz Republic and Government of Kyrgyzstan; development reports (World Bank, IMF) on remittances and digital finance; news on the national stablecoin launch[15][2][1]; and regional analysis of digital currency impacts[4][9]. All information presented uses the latest available data and adheres to the branding and formal tone appropriate for an executive policy briefing.

[1] [11] Kyrgyzstan Digital Currency Strategy: Stablecoin KGST & CBDC Launch – News and Statistics – IndexBox

https://www.indexbox.io/blog/kyrgyzstan-advances-digital-currency-with-national-stablecoin-and-cbdc

[2] [15] Kyrgyzstan launches national stablecoin in partnership with Binance | Reuters

[3] [6] remittanceprices.worldbank.org

https://remittanceprices.worldbank.org/sites/default/files/digitizing_remittances_kyrgyzrep.pdf

[4] [5] [8] [10] [12] [13] [14] [17] Central Asia’s Digital Currency Ambitions: New Opportunities and Old Constraints – The Times Of Central Asia

[7] Kyrgyzstan: Economy – globalEDGE – Michigan State University

https://globaledge.msu.edu/countries/kyrgyzstan/economy

[9] Kyrgyzstan: Next technological hub in Central Asia? – REGARD SUR L’EST

[16] How Stablecoins Can Improve Payments and Global Finance